Author’s note: Although limiting the Federal Reserve is the core mission of Solidus.Center, it’s also important to expose the egregious behavior of Fed-enabled Big Banks.

Two traders from the United Arab Emirates, Heet Khara and Nasim Salim, were recently suspended for manipulating the price of gold and silver on the Chicago Mercantile Exchange. The two traders utilized a technique called “layering”, the same technique that Navinder Singh Sarao utilized to facilitate the Flash Crash of 2010, which plunged the stock market 600 points in a matter of minutes. Layering is a remarkably simple technique: traders merely place tremendous amounts of orders and the cancel them just before they’re processed. Nearly anyone could do it.

The mere fact that the two traders–foreign nationals operating from the Middle East no less–were able to spoof the market years after Sarao was prosecuted for the using same technique demonstrates that the Commodity Futures Trading Commission isn’t serious about protecting the purity of price discovery. In fact, there’s a preponderance of evidence that the CFTC has allowed price rigging on a much larger scale for decades.

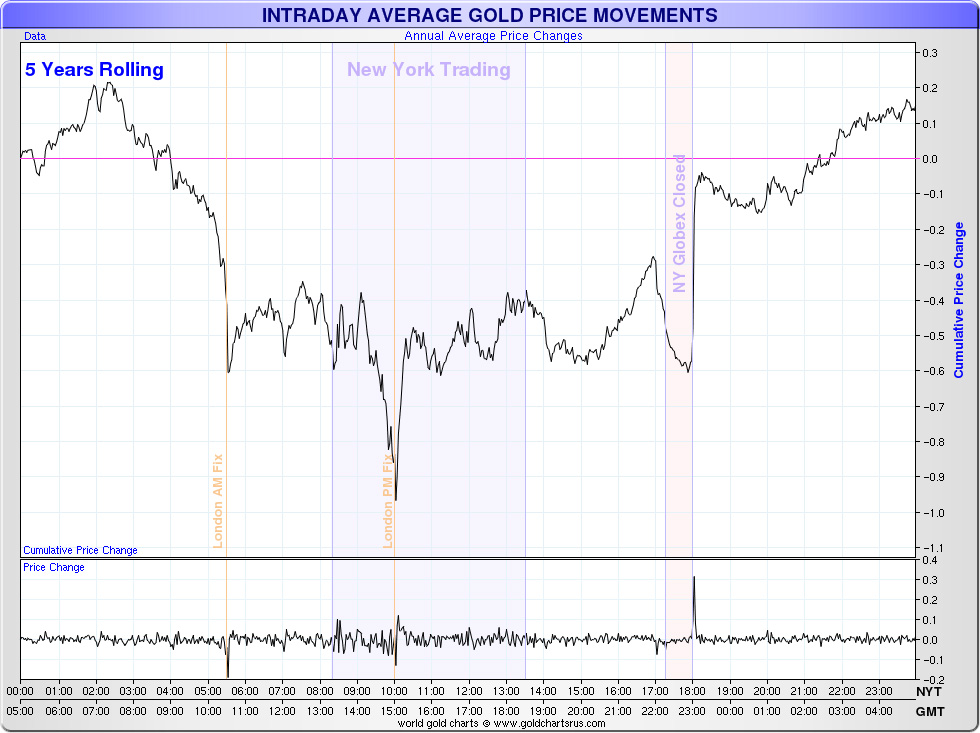

Consider the following chart from Casey Research, which demonstrates the discrepancy between intraday gold prices when American markets are open and when they aren’t:

As you can clearly see, prices are suppressed when U.S. markets are open. This pattern has held since at least 1970. Now, using another chart from Casey, let’s consider how this has affected bullion investments on a macro scale. The yellow line is the price of gold. The blue line is the value of a theoretical $100 investment made in 1970:

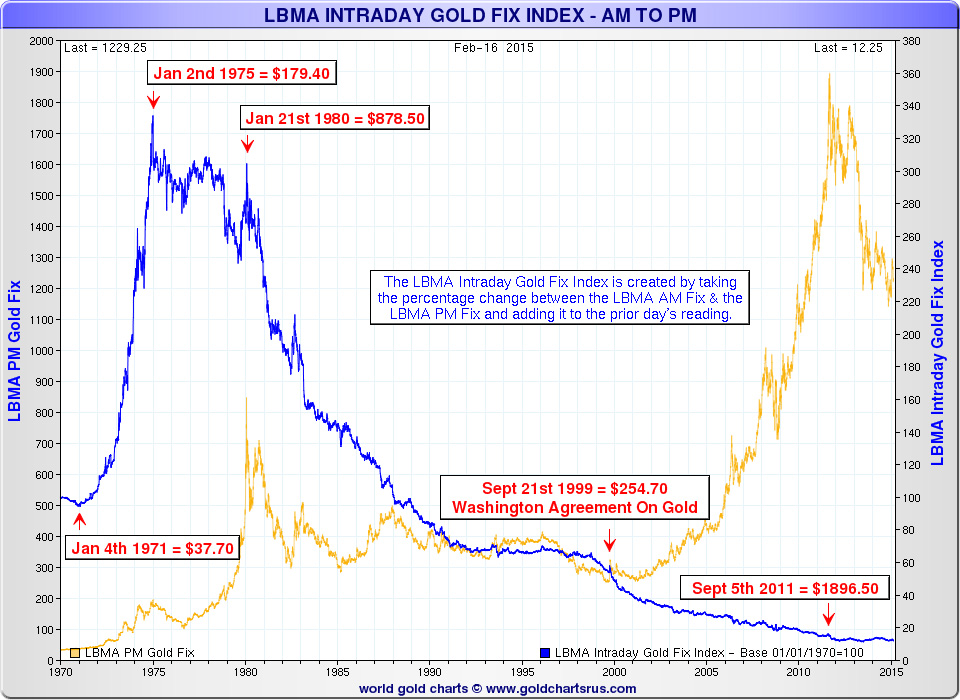

As you can clearly see, prices are suppressed when U.S. markets are open. This pattern has held since at least 1970. Now, using another chart from Casey, let’s consider how this has affected bullion investments on a macro scale. The yellow line is the price of gold. The blue line is the value of a theoretical $100 investment made in 1970:

This chart demonstrates that, if, for the past 45 years, you invested $100 at the London AM gold fix, sold your position at the London PM gold fix the same day, then reinvested the proceeds the next day and repeated the process every trading day since, you’d have just $12 in your account today. On the other hand, if you had simply held your position, your $100 investment from 1970 would now be worth well above $2,000 today. AND, if you had reinvested daily with the AM and PM trades in reverse, it would be worth more than $10,000! In other words, for nearly a half a century, there’s been a HUGE negative price bias when Western markets have been open–particularly during the hours in which the CME has been operating–, and the bias has remained consistent regardless of the price of gold or price trends. This suggests that the CFTC has allowed tremendous collusion to suppress the price of gold during the CME’s hours of operation.

This chart demonstrates that, if, for the past 45 years, you invested $100 at the London AM gold fix, sold your position at the London PM gold fix the same day, then reinvested the proceeds the next day and repeated the process every trading day since, you’d have just $12 in your account today. On the other hand, if you had simply held your position, your $100 investment from 1970 would now be worth well above $2,000 today. AND, if you had reinvested daily with the AM and PM trades in reverse, it would be worth more than $10,000! In other words, for nearly a half a century, there’s been a HUGE negative price bias when Western markets have been open–particularly during the hours in which the CME has been operating–, and the bias has remained consistent regardless of the price of gold or price trends. This suggests that the CFTC has allowed tremendous collusion to suppress the price of gold during the CME’s hours of operation.

Collusion on this scale, which Germany’s top financial regulator Elke Koenig has called “potentially worse than the Libor scandal”, can only be accomplished by a cabal of firms of tremendous size and power: investment banks.

Indeed, 10 major investment banks are being investigated by the the Justice Department for colluding to rig precious metals prices. Not surprisingly, this same group of banks spends tens of millions of dollars annually on lobbying, and, in return, has enjoyed tremendous influence over the CFTC (including implicit permission to rig prices for 45+ years). The commission, for example, recently fined JP Morgan just $650k for years of data falsification on the CME and fined 6 of the 10 aforementioned banks a small percentage of their annual operating budgets for years of rigging foreign exchange rates!

The power of investment banks over the Commodity Futures Trading Commission is impressive.

One CFTC whistleblower, Judge George H. Painter, claimed in his retirement letter that a colleague of his, Judge Bruce Levine, promised former CFTC Chair Wendy Gramm that he would never rule in a complainant’s favor against a Big Bank. More than two decades presiding over investor complaints with the CFTC, Judge Levine has, in fact, never ruled in favor of a complainant.

Back to Khara, Salim, and Sarao. These three traders were busted because their layering technique required them to place and subsequently cancel tens of thousands of orders at once. The volume of the cancellations raised yellow flags. Now, consider the difference between the actions of these 3 traders and those of investment banks working in concert which, through large numbers of individual traders, have the ability to move entire markets with no individual account making enough trades to raise suspicion. The aggregate of tens of thousands of traders from a handful of investment banks making a few hundred trades a day each has far more potential to manipulate prices than the individuals Khara, Salim, and Sarao did with the 30,000 or so orders they each placed to suppress the market.

CFTC-enabled investment banks, not rogue traders, pose the greatest threat to the purity of price discovery on the CME. Occasionally busting rogue traders is mere political theater that distracts the public from the much larger issue.

Seth Mason, Charleston SC