Author’s note: I apologize for the limited updates over the last few months. I’ve been working hard getting my new landscaping venture off of the ground, and I’ve had little time for anything else.

Nearly seven years ago, way back in 2009, Keynesian economists were coming out of the woodwork to crow about the “green shoots” and the “V-shaped recovery” the Fed had engineered with its loose monetary policy. Today, in the latter part of 2015, nearly SEVEN YEARS of zero interest rates and trillions upon trillions of printed dollars later, the job market continues to plod along so slowly that it can’t handle a mere 1/4 of a percent rate hike. The better part of a decade later, when the “green shoots” should have grown into colossal redwoods and Joe Wage Earner should be overlooking his American dream from the precipice of the capital “V”, the Fed is not only having to postpone the tiniest bit of tightening; it’s actually expected to loosen more. The people of the Eccles Building must add yet another story to their monetary house of cards to perpetuate this never-ending farce of a “recovery” from the bursting of their housing bubble so many years ago.

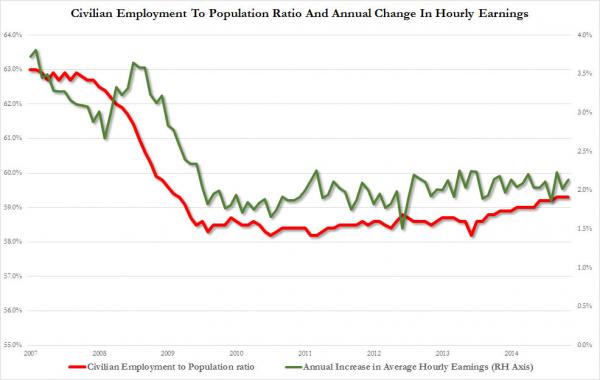

To say that the Fed has failed to engineer a jobs recovery is the understatement of our time. Until just recently, Wall Street had been going gangbusters, of course, with many asset classes doubling in price over the last 7 years. But, back on Main Street, Joe Wage Earner has remained on the ropes since his pummeling the better part of a decade ago. (Note that the lines decoupled during the beginning of the Fed’s bubble/burst economic paradigm in the late 1990s.)

The majority of jobs created during the Fed’s “recovery” have been of the low-paying service sector variety: customer service reps, office clerks, food servers, and the like. And wages remain depressed across the board, along with the percentage of Americans in the workforce.

The majority of jobs created during the Fed’s “recovery” have been of the low-paying service sector variety: customer service reps, office clerks, food servers, and the like. And wages remain depressed across the board, along with the percentage of Americans in the workforce.

It should be crystal clear now that the sputtering “recovery” the Fed has engineered–a boon for wealthy asset holders–has been a abject failure for the American worker, for whom the Fed is supposedly mandated to help. But, instead of standing on the precipice of a capital “V” seven years after the bursting of the Fed’s housing bubble, Joe Wage Earner stands at the edge of an upside-down square root sign, his future still uncertain.

It should be crystal clear now that the sputtering “recovery” the Fed has engineered–a boon for wealthy asset holders–has been a abject failure for the American worker, for whom the Fed is supposedly mandated to help. But, instead of standing on the precipice of a capital “V” seven years after the bursting of the Fed’s housing bubble, Joe Wage Earner stands at the edge of an upside-down square root sign, his future still uncertain.

The endless plight of the American worker demonstrates that you can’t drive jobs growth through a central bank. Unless you’re driving it off of a cliff.

Question: If the job market has been this bad during this “recovery”, how bad is it going to be when the current Fed-inflated, multi-faceted asset bubble pops?

Seth Mason, Charleston SC