In a 2002 letter to shareholders, Berkshire Hathaway CEO Warren Buffett called the trillions of dollars of derivatives held by American banks “time bombs”. The “Oracle of Omaha’s” dire prognostication proved correct in 2008, when the collapse of prices of the assets to which the lion’s share of outstanding derivatives were tied led to a financial crisis that plunged the American economy into a period of economic malaise not seen since the Great Depression.

Derivatives are indeed “ticking time bombs” in this era of Fed-inspired asset price bubbles and guarantees of multi-trillion dollar bailouts of the Big Banks. But they weren’t always so dangerous. Prior to the Fed’s bubble/burst economic paradigm, derivatives were considered hedges against counter-party risk.

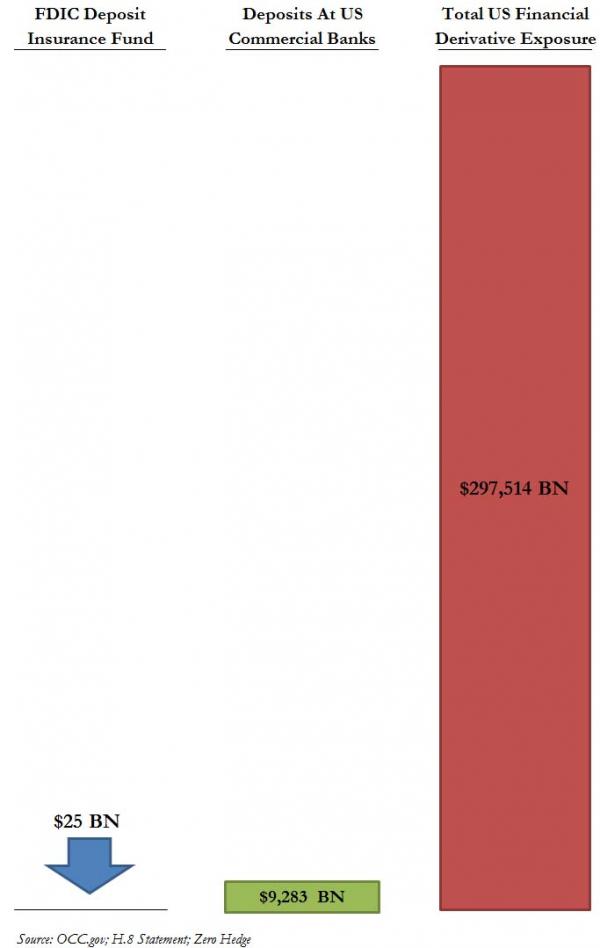

Coinciding with the bubble/burst economic paradigm the Fed has been engineering since the late 1990s, the Big Banks have been hording derivatives over the past decade-and-a-half. Today, the nation’s 4 largest banks–JPMorgan, Citi, Bank of America, and Goldman Sachs–hold a mind-boggling $200 trillion in them. As you can see from the following chart, the current derivative-to-deposit ratio is a mind-blowing 11,900-to-1!

The Big Banks have exponentially increased their derivative exposure over the past 15-or-so-years for three reasons: 1) They’ve been pumped massive amounts of cheap liquidity from the Fed with which to recklessly invest. (The ratio could not be 11,900-to-1 without funny money from the Fed.) 2) They’ve profited immensely from derivatives during periods of Fed-inspired asset price bubbles. 3) They’ve been insulated from losses–by way of bailouts from the Fed–when the Fed’s asset price bubbles have popped and crashed the derivatives market.

If the Fed were limited in its ability to inflate asset bubbles and bail out the Big Banks when its asset bubbles pop, the latter would be far less inclined to horde derivatives and expose the U.S.–and world–economy to danger. Prices of the assets to which derivatives are tied would be more stable, the Big Banks wouldn’t have cheap money from the Fed with which to throw around, and big bankers such as JPMorgan’s Jamie Dimon–who personally lobbied for deregulation of the derivatives market as part of the recent federal spending bill–would be far more careful about derivative exposure in the absence of guaranteed bailouts.

The Fed has transformed derivatives into low-risk/high-yield golden eggs for the Big Banks that become high-risk/high-yield time bombs for the economy at large. Limit the Fed, diffuse the bombs.

Seth Mason, Charleston SC