Although I stated just over a week ago that I was going to put Solidus.Center on the back burner and focus on my new landscaping venture, I came across an excellent article regarding the U.S. employment situation during the Fed’s 15+ year bubble/burst economic paradigm that compelled me to write. The article, by former Reagan budget director David Stockman, one of the most vocal critics of the Federal Reserve, reflects my recent “parting thought” regarding the Fed, but from the perspective of those hurt most by the decade-and-a-half Greenspan/Bernanke/Yellen bubble/burst paradigm, the American middle class worker:

…nor do these contrasting trends encompass a mere short-term aberration. The death of the US jobs market has been underway for a decade and one-half!

Indeed, the six-year run of job gains since early 2010 primarily represents “born-again jobs” and part-time gigs. In economic terms, they do not remotely resemble your grandfather’s industrial era economy when a “job” lasted 40 to 50 hours per week all year round; and most of what the BLS survey counted as “jobs” paid a living wage.

Not now. Not even close.

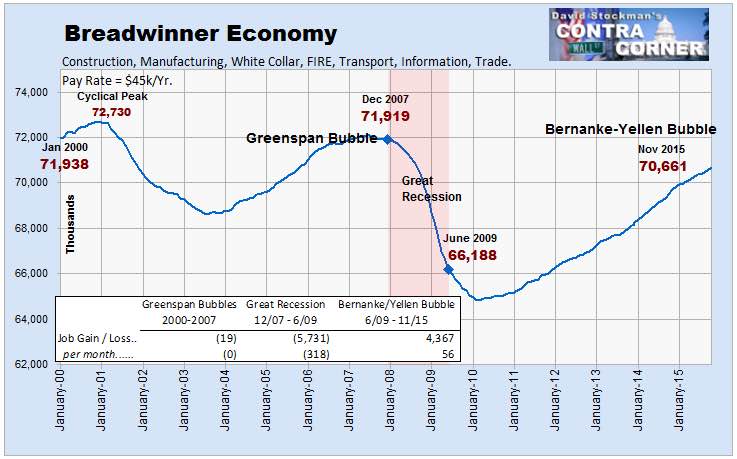

Here’s a chart from Stockman’s article that shows how the Fed hurts America’s middle class the most: by taking away their “breadwinner jobs”, jobs that allow them middle class status:

As you can see, the instability of the economy during the Fed’s bubble/burst economic paradigm (see the charts section of this page to get a clear understanding of it) has stunted the growth of jobs that pay $45k or more such that there are FAR FEWER of them per capita than there were at the peak of the tech bubble in 2000. The U.S. population has grown by some 40 million since 2000, there are nearly 2 million FEWER breadwinner jobs in this country than there were 15 years ago!

As you can see, the instability of the economy during the Fed’s bubble/burst economic paradigm (see the charts section of this page to get a clear understanding of it) has stunted the growth of jobs that pay $45k or more such that there are FAR FEWER of them per capita than there were at the peak of the tech bubble in 2000. The U.S. population has grown by some 40 million since 2000, there are nearly 2 million FEWER breadwinner jobs in this country than there were 15 years ago!

By destroying breadwinner jobs through its 15+ year bubble/bust economic paradigm, the Fed has been destroying America’s middle class. To save the middle class, the Fed’s bubble/burst paradigm must be destroyed.

Seth Mason, Charleston SC

Author’s note 01/25/16: One can’t talk about reforming the Fed without advocating the reinstatement of Glass–Steagall Legislation. Read this to learn how the repeal of Glass–Steagall has helped multiply the Fed’s damage to the the economy, particularly to the job market.